Earnthehighestnetyieldonyourstablecoins

Access 12% real, asset-backed returns from tokenized receivables—fully on-chain, and backed by institutional-grade underwriting.

Trusted by leading institutions

RWAmeetDEFItobuildthefutureofreceivablefinancingonchain

Real receivables tokenized on-chain, real liquidity deployed, and real yield generated—across multiple networks.

Receivables

Value of receivables committed by originators to the protocol.

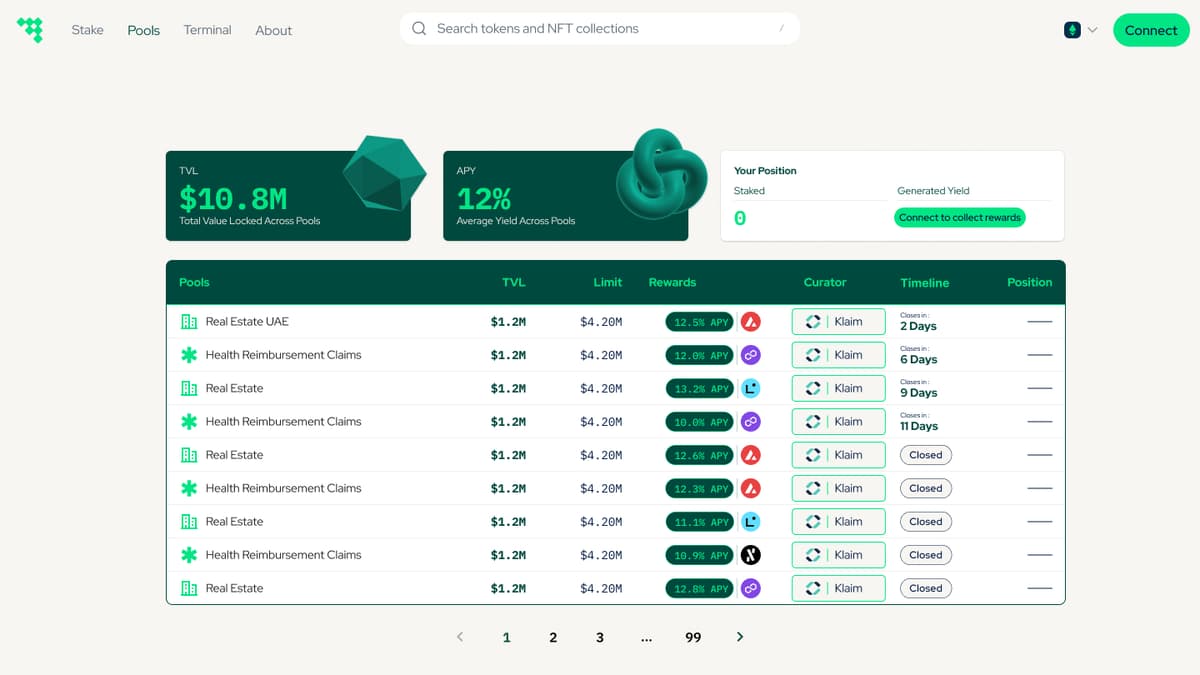

TVL

Total value invested by lenders to the finance receivables.

Average APY

Average annual yield earned by lenders on test pilots.

Networks

Blockchain networks where Factor is deployed.

Join Factor TestNet

Help us build the future of receivable financing

RWAmeetDEFItobuildthefutureofreceivablefinancingonchain

Real receivables tokenized on-chain, real liquidity deployed, and real yield generated—across multiple networks.

TradFi Safety Meets DeFi Yields

Your stablecoins are backed by verified business receivables with institutional-grade underwriting. Get DeFi yields with TradFi security and transparency into every asset.

Fixed APY, Zero Volatility

Lock in fixed APYs averaging 12%+ with predictable payouts at regular intervals. No liquidation risk, no price volatility—just consistent, stable returns.

Exit Anytime, Stay Liquid

Lockup periods under 2 months with instant liquidity through tradable ERC4626 tokens. Exit your investment anytime without waiting for maturity—your capital, your timeline.

Multi-Chain, Seamless Access

Access Factor on Polygon, Linea, Avalanche, Alephium, and Oasis Sapphire. Seamless cross-chain bridging means you can deploy from your preferred network without friction.

Frequentlyaskedquestions

Straight answers about yield, risk, liquidity, and protocol mechanics.